Do you know there are currently about 13.5 to 15.7 million women-owned enterprises in India. Women are starting and running small businesses like never before—some from their kitchens, others from tailoring shops, art studios, or mobile phones. But no matter the size or type of the venture, one thing connects them all: the need to receive payments easily, securely, and professionally.

With digital literacy and smartphone penetration, more buyers now expect a smooth, cashless experience. Whether you run a home bakery or sell on Instagram, having the best online payment system for small business is no longer optional—it’s your foundation for growth.

But how do you choose the digital payment system? What digital payment system works if you don’t have a website? Which digital payment system gives you faster settlements or lower transaction fees? Below is a simple step-by-step breakdown of the best online payment system for small busienss in India.

How to set the best online payment system for your business:

Step 1: Understand What Your Business Really Needs

Before choosing the best online payment system, consider how your business functions. Are you a local vendor receiving orders through WhatsApp or Instagram?Then, a UPI payment system for small businesses may be all you need. Are you a digital service provider or freelancer working with clients across India? A payment link solution may work better. But if you run a business with a growing customer base and have a website, a full-fledged payment gateway offers more features.

Step 2: Types of Online Payment Systems for Small Businesses in India

There are different kinds of online payment systems for small businesses in India. Below are some of the most preferred ones:

1. UPI-Based Payment Apps

UPI apps like Google Pay, PhonePe, Paytm, and BHIM have made digital payments easy for everyone. Sellers can receive instant payments through QR codes without any setup fees. These apps are widely used by businesses, market vendors, and home-based sellers. If your customers are mainly in India and use UPI, this is the simplest way to start accepting digital payments.

2. Payment Gateways

Platforms like Razorpay, Instamojo, PayU, and Cashfree help you accept payments via multiple modes—credit/debit cards, net banking, UPI, wallets, and even EMI. If you operate online or sell via a website and need advanced features like invoicing, subscriptions, or analytics, choose payment gateways. Some of these also allows you to send payment links without a website.

3. Payment Links

If you’re a freelancer, service provider, tutor online, a service provider or a coach, payment links can be your best bet. Links enables you to receive payments by merely sending a URL to your customer. You can do this using Razorpay, Instamojo, or PayU. No website or coding required, just send the link over WhatsApp, email, or SMS.

4. POS (Point of Sale) Machines

If you have a physical outlet or engage in flea markets or exhibitions, you need a swipe machine or card reader for payment. Paytm, Pine Labs, and most Indian banks offer POS systems that accept card payments and QR codes.

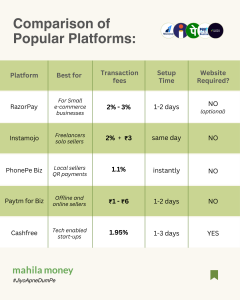

Step 3: Compare the Best Online Payment Systems in India

There are few factors to consider when choosing the best online payment system for your small business —transaction fees, ease of use, customer support.

Each platform has its strengths, so choose the one that suits your business setup. For instance, Instamojo for small business works well without a website, while Razorpay is ideal for a growing D2C brand.

Step 4: Documents Required to Set Up Online Payment System

To set up an online payment system for your small busienss you’ll need:

- PAN card (personal or business)

- Aadhaar card for KYC

- Bank account details

- A business document (optional)—like GST certificate or MSME registration

- A website or active social media handle (for verification)

Some platforms allow you to register even if you don’t have formal business proof. A win-win for women running informal or home-based business.

Step 5: How to Set Up an Online Payment System

Setting up a payment system for your small business is requires minimal effort. Here’s how to go about it:

A. For QR-Based Payments (UPI Apps like PhonePe Biz, Google Pay Business)

- Download the business version of the app.

- Register using your mobile number and business name.

- Complete KYC using Aadhaar and PAN.

- Link your bank account.

- Generate your UPI QR code.

- Print or save the QR.

- Stat collecting payment.

This method is quick, zero-cost and works even if you’re just starting out.

B. For Payment Gateways (Razorpay, Instamojo, PayU)

- Sign up on the official website.

- Upload your KYC documents.

- Add your business and bank details.

- Once verified, integrate with your website or generate payment links.

- Access your dashboard to monitor sales, invoices, and payouts.

This set-up can give you more control and branding as your business scales.

C. For Payment Links (Without Website)

- Create an account on Razorpay, Instamojo, or PayU.

- Go to the dashboard and select “Create Payment Link.”

- Enter the amount and customer details.

- Share the link via WhatsApp or email.

- Once paid, the amount is settled into your bank account (usually within 2–3 days).

This is a good option for freelancers, and service-based entrepreneurs.

Step 6: What to Look for When Selecting the Right Payment System

With so many choices, how do you choose the best payment system for your small business in India?

Following are some things to consider:

- Ease of Use: The interface, dashboard and reporting should be simple.

- Payout Time: Faster settlements mean better cash flow.

- Customer Support: Responsive help can save you time and stress.

- Security: Choose platforms that offer fraud protection and PCI-DSS compliance.

- Mobile Access: If you’re on the move, mobile-friendly apps help track sales in real time.

No system is perfect, but finding one that aligns with your current and future business needs can save you a lot of effort in the long run.

Step 7: Keep It Safe – Best Online Payment System Practices

Once your system is in place, keeping it secure should be a top priority. A few basic but essential tips:

- Never share OTPs or login credentials with anyone.

- Use two-factor authentication on your payment platforms.

- Check your transactions regularly for any unusual activity.

- Use a separate bank account for business payments, to avoid mix-ups.

- Don’t click on suspicious payment links sent by customers or strangers.

The more secure your system is, the more trust you build with your customers.

FAQs: What Small Business Owners Often Ask

Q. I don’t have a GST number. Can I still set up online payments?

Yes. Many platforms like Instamojo and Razorpay allow sellers to sign up as individuals without GST. However, for scale or invoicing, a GST number helps.

Q. How fast will I get the money in my account?

UPI payments are instant. For payment gateways, it usually takes 1–3 working days for funds to reflect in your bank account.

Q. Can I accept international payments?

Yes, platforms like Razorpay (with international settings enabled), Stripe, and PayPal allow global transactions. You may need to submit additional documents and ensure compliance with RBI norms.

Conclusion: Start Smart, Grow Steady

Getting paid shouldn’t be a challenge—it should be part of your growth journey. With so many online payment systems for small businesses in India, there’s no reason to delay going digital. Whether you’re just starting with WhatsApp orders or launching your first website, the best online payment system is out there for you.

Thousands of entrepreneurs—many just like you—have made the switch. And they’ve found that getting paid online doesn’t just make business smoother—it makes it real.

Take your time, compare your options, and choose the payment system that helps your business feel not just easier, but more professional.

Read more:

Licenses Required for Homemade Cosmetics in India: A Complete Guide for Entrepreneurs

How to Separate Personal and Business Finances: 10 Actionable Tips

What Licenses Do You Need to Run a Cloud Kitchen in India?

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money