More than 20% of MSMEs in India are women-owned. These businesses are often small, home-based, and rooted to the local economy.

Yet, despite their potential, many women entrepreneurs find it difficult to access business loans, government schemes, or supplier contracts. However, it can all change with a single step, MSME registration online.

If you are a woman entrepreneur running a business, whether it’s a boutique, food venture, or digital service, getting your business registered as an MSME (Micro, Small and Medium Enterprise) can give you access to credit, subsidies, tenders, and growth opportunities. In this blog, we break down everything you need to know about MSME registration online, its process, eligibility, and benefits, especially for women entrepreneurs in India.

What is MSME Registration?

MSME registration is a government process that recognises a business as a micro, small, or medium enterprise. This registration is now done through the Udyam Registration Portal, launched by the Ministry of Micro, Small and Medium Enterprises, Government of India.

Once registered, your business receives a unique Udyam Registration Number (URN) and a digital certificate. This certificate is useful when applying for business loans, government schemes, startup grants, or public procurement tenders.

Why is MSME Registration Important for Women Entrepreneurs?

For women business owners, formalising a business through MSME registration brings recognition, financial inclusion, and eligibility for multiple support schemes. According to government estimates, only about 20% of registered MSMEs are women-led, leaving a large number of enterprises outside the formal credit ecosystem.

Here’s why registering is essential:

- Makes your business visible to lenders and banks

- Helps you apply for low-interest loans and government incentives

- Enables participation in government procurement programs, where 3% is reserved for women entrepreneurs

- Gives you access to skill development, technology support, and export promotion schemes

Who Can Register Under MSME?

The following types of businesses are eligible:

- Sole proprietors and individual businesswomen

- Partnerships and LLPs

- SHGs and women’s collectives

- Traders, service providers, and manufacturers

- Home-based enterprises (such as tailors, beauty parlours, catering services)

To be eligible, your business must fall under the limits defined by the MSME classification.

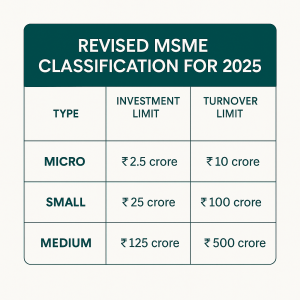

As of the latest update in 2025, the Government of India has revised the criteria for MSME classification to support broader growth and inclusion.

The limits are now:

This revision helps more growing businesses qualify for MSME benefits.

Most women-led businesses, including boutiques, food businesses, and service enterprises, fit comfortably into the micro or small category under these updated limits.

Step-by-Step Process of MSME Registration Online (Udyam Registration)

Registering your business under MSME is simple and completely online. Here’s a step-by-step breakdown:

- Visit the official website: udyamregistration.gov.in

- Click on “For New Entrepreneurs who are not Registered yet”

- Enter your Aadhaar number and validate with OTP

- Provide PAN number, business name, and type of organisation

- Enter business activity, location, and NIC code (available on the portal)

- Fill in your bank details

- Submit the form and download your Udyam Registration Certificate

This entire process is free. You do not need an agent or consultant.

Documents Required for MSME Registration

You’ll need just a few documents:

- Aadhaar number (linked with your mobile)

- PAN card

- Business address

- Bank account details

- Optional: GST number (only if available)

Note: No physical documents are required to upload.

Key Benefits of MSME Registration for Small Businesses

Once your business is registered, you can access multiple benefits. These include:

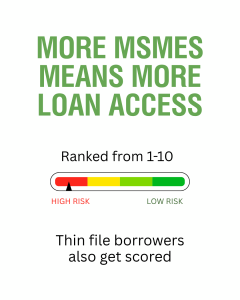

1. Easier Access to Credit

Women can apply for business loans under government or private financial schemes, often with lower interest rates.

2. Government Subsidies

You become eligible for schemes like PMEGP, Mudra Yojana, and Credit Guarantee Fund.

3. Protection Against Late Payments

The MSME Act protects registered businesses from delayed payments by customers or large buyers.

4. Ease in Licensing and Approvals

Registered MSMEs get priority in regulatory and licensing processes.

5. Participation in Public Procurement

3% of government tenders are earmarked for women-owned MSMEs.

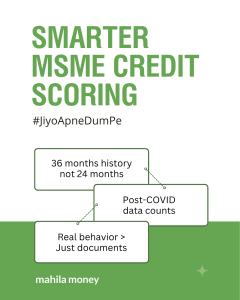

Smarter Credit Scoring for MSMEs: What’s New in 2025?

With the 2025 update, credit scoring for MSMEs is also becoming smarter and fairer, especially for small women-led businesses.

Lenders are now using 36 months of business history (instead of just 24 months)

Post-COVID performance is being counted, not penalised

More focus on real business behavior, not just documents

This shift helps women who’ve been consistently running small ventures, even informally get better access to formal credit.

Common Myths About MSME Registration

Let’s clear up a few misconceptions:

- Myth 1: MSME is only for large businesses

- Fact: Even a solo home-run business qualifies.

- Myth 2: Only manufacturers can register

- Fact: Service providers and traders are eligible too.

- Myth 3: You need a GST number

- Fact: It’s optional for businesses below the GST threshold.

- Myth 4: MSME registration is complicated

- Fact: It takes under 15 minutes if your Aadhaar is linked to your mobile.

Frequently Asked Questions (FAQs)

Q1. Is MSME registration compulsory?

No, but it is highly recommended if you want access to finance and schemes.

Q2. Can I register a home-based or part-time business?

Yes, even small and seasonal businesses can register.

Q3. Is GST registration mandatory for MSME?

No, unless your turnover exceeds ₹40 lakh (for goods) or ₹20 lakh (for services).

Q4. Can I update my MSME details later?

Yes, you can log in to the Udyam portal and make changes anytime.

Final Thoughts

For women running small businesses in India, MSME registration is not just a legal step, it’s a gateway to growth. It improves your chances of getting a loan, being noticed by buyers and banks, and scaling your venture with government support.

If you haven’t registered yet, consider doing it today. It’s simple, free, and online. And if you need help with funding post-registration, Mahila Money is here to support your journey.

Read more:

Licenses Required for Homemade Cosmetics in India: A Complete Guide for Entrepreneurs

How to Separate Personal and Business Finances: 10 Actionable Tips

What Licenses Do You Need to Run a Cloud Kitchen in India?

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money

Super helpful blog! 🙌

MSME registration ka process pehle confusing lagta tha, but yeh guide padke kaafi clear ho gaya.

Perfect for small business owners like me! 💼🌟