Despite over 20% of India’s MSMEs being women-led, a large number of women entrepreneurs in India struggle to access formal credit, often due to missing or incomplete paperwork. Knowing the right documents to apply for a loan not only speeds up the process but also increases your chances of approval. This blog walks you through the must-have documents to apply for a loan, how to organise them, so that you can apply with confidence.

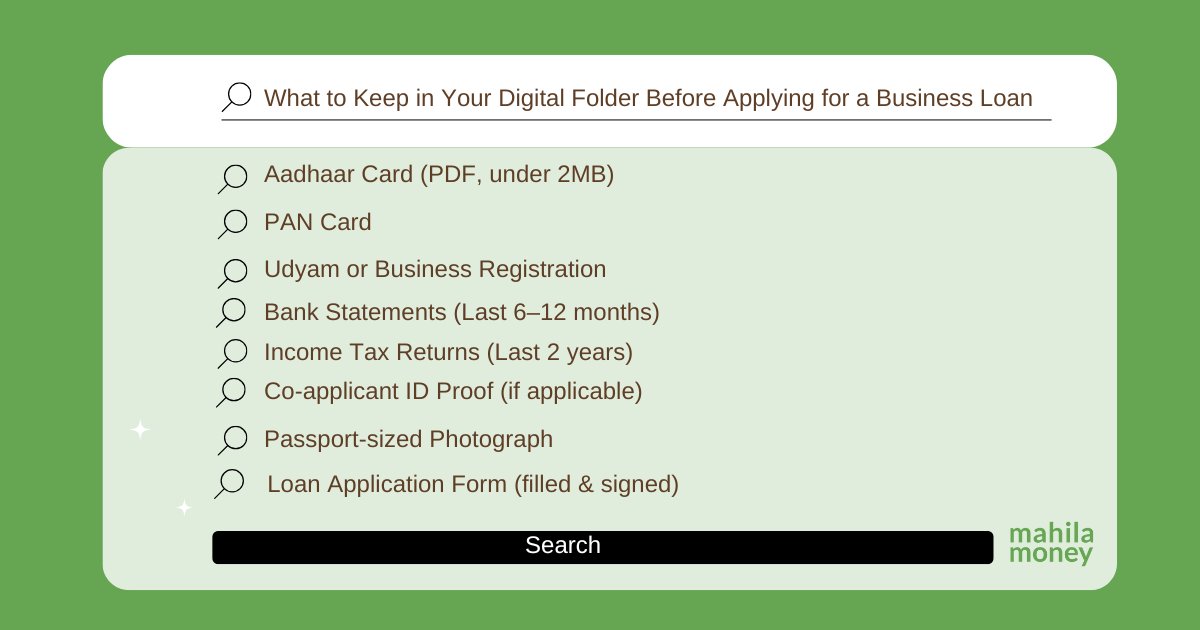

Essential Documents to Apply for a Loan:

1. Verifying Your Identity: Personal Documents

Every loan application journey begins with verifying your identity. Financial institutions asks for a set of personal identification documents. These are essential business documents needed to prevent fraud, verify age and nationality, and ensure that capital is being offered to a legitimate borrower.

Most commonly requested personal documents include:

- Aadhaar Card: Primary ID used in both traditional and digital lending. Ensure it is updated with your current address.

- PAN Card: Critical for income verification and credit checks. PAN is also used to access your credit score, so any error here can impact your loan eligibility.

- A secondary proof of identity such as a Voter ID, Passport, or Driving Licence, may also be required, depending on the lender.

Mismatches between documents, such as a different spelling of your name or conflicting addresses, can lead to loan application rejection. It’s essential to cross-verify every detail before uploading your KYC.

2. Proving Your Business Legitimacy: Business Documents

If you’re applying for a business loan, lenders need to confirm that your business exists and is operational. In the absence of a proper business registration certificate, many women find their loan applications refused, especially when applying to formal institutions.

So, how do you prove that your business is real?

If you’re a registered MSME, your Udyam Registration Certificate becomes your biggest asset. It validates your business under India’s official MSME framework, and many MSME loan schemes even mandate it. If you’ve registered for GST, your GST Registration Certificate is another key proof.

For those running small or home-based businesses, such as beauty parlours, tailoring services, or packaged food ventures, the proof may be more localised. A Shop and Establishment Licence, FSSAI licence (for food businesses), or even a municipal trade license can work.

In the case of partnerships, ensure your Partnership Deed is signed and notarised. Sole proprietors can submit a proprietorship declaration or utility bill in the business name, if registration has not been formalised yet.

Having strong business documentation increases your credibility and often speeds up the verification process with lenders. It also opens up doors to government schemes, subsidies, and sector-specific support. Here are some tips to apply for a business loan.

3. Showing Your Financial Health: Income and Bank Records

This is the part which gives jitters to most women entrepreneurs. They either hesitate or feel underprepared when it comes to presenting their business financial records. However, remember that lenders don’t just lend based on ideas. They need to see how your business performs financially and whether you can repay the loan on time. This is where financial documentation plays a critical role.

At a minimum, you’ll need to submit:

- Bank statements for the last 6 to 12 months. Your business accounts gives a clearer picture of how cash flows in your setup.

- Your Income Tax Returns (ITRs), preferably for the last two financial years. Many lenders, especially for loans above ₹1 lakh, ask for these to assess both personal and business income.

- If available, share a basic Profit and Loss statement or a Balance Sheet, especially if your business has existed for more than a year. These documents reflect your expenses, revenue, and profitability.

Having these financial documents ready boosts your loan approval chances, because they directly impact your creditworthiness. It also shows your repayment ability. If you’ve had loan rejections in the past and didn’t provide these documents, this could be one of the key reasons.

4. Supporting Your Loan Application: Forms, Photographs, and Co-applicants

Your loan application form brings everything together. This filled form includes details about:

- Your business

- Loan amount requested

- Purpose of the loan (working capital, machinery, raw materials, etc.)

- Repayment plan or tenure preference

Additionally, most lenders will request a recent passport-size photograph, which gets added to your loan file.

If a co-applicant is co-signing your loan, say, your spouse or parent, make sure their PAN, Aadhaar, and income details are submitted along with your own. This can strengthen your loan profile, especially when you’re just starting out.

Some lenders, especially those offering equipment loans or inventory purchases, also require a quotation or invoice for the items being purchased. This explains why the loan is needed.

5. Optional but Beneficial: Documents That Give You an Edge

While the documents above are generally mandatory, there are some optional documents that can give you an advantage, especially when applying for larger loan amounts, or if you’re borrowing for the first time.

These include:

- Your Credit Report (CIBIL score or Experian). This helps lenders quickly assess your credit history. A score above 700 improves your chance of faster approval.

- A simple letter of intent or business plan. Especially useful for women who are just starting out or working in the informal sector. This gives lenders context and shows how you plan to use the funds.

Having these ready signals that you’re well-prepared, professional, and serious about your business goals.

Final Thoughts: Documentation Isn’t Just Paperwork – It’s Power

For any woman running her own business, having a clear understanding of the documents to apply for a loan is just as important as knowing your product or customer. It’s not just about compliance, it’s about presenting yourself as a confident borrower, a capable entrepreneur, and a business owner who is ready to grow.

Documentation tells your business story in numbers and records. It helps lenders see your potential on paper. And once you’ve got this part sorted, applying for credit becomes less stressful and far more empowering (without using the word, by the way).

So before you hit “apply,” take a pause. Gather, organise, and double-check your documents. Keep soft copies ready in a cloud folder. And if in doubt, always ask the lender upfront what’s needed.

Your paperwork is your power. Use it wisely.

Still unsure if your documents are loan-ready? Want real-time help before you apply?

Join the Mahila Money Loan Open House – live every Monday to Friday, 12:00 to 12:45 PM.

A Mahila Money loan representative will guide you, answer your doubts, and help you understand the loan process in real time.

Download the Mahila Money app to attend the Open House and get one step closer to securing your business loan with confidence.

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money