Do you know that, despite owning 20% of businesses, women in India receive less than 5% of formal credit? Traditional banks advertise big promises – collateral-free loans, easy documentation, and women-first lending, but the reality on the ground is very different.

So, what aren’t they telling you? And what can you do differently?

Let’s break it down.

In this blog, we’ll share real business loan tips, practical advice, and the truth behind the process. Especially what traditional banks don’t openly share with women entrepreneurs when they apply for a business loan.

Whether you’re applying for your first MSME loan or looking to scale your home business, here’s what you need to know.

Business Loan Tips for Women Entrepreneurs in India

1. Understanding Eligibility: It’s More Than a Checklist

Most women entrepreneurs begin their business loan journey by reviewing the basic eligibility criteria, including age, KYC, and business vintage. But traditional banks often have internal filters that aren’t visible upfront.

Business Loan Tips: Always ask the bank about actual disbursal rates, co-applicant needs, and documentation expectations before submitting your application.

Hidden factors some banks consider:

- Business registration proof: Women running home-based and informal businesses are often sidelined.

- Income documentation: Self-declared income is often questioned unless backed by GST or invoices

- Ownership of assets: Many banks still prefer collateral or male co-guarantors

Even for “unsecured loans,” women often find themselves being asked for:

- Property papers

- Business premises lease agreements

- ITRs for the past 2–3 years

2. Credit Scores Matter More Than You Think

Many women applying for business loans discover that they have either a low credit score or no score at all. This becomes a hurdle, especially when banks fail to explain the implications clearly.

Business Loan Tips: Check your credit score before applying for a loan. A score above 700 is ideal for most banks and NBFCs.

Why women struggle here:

- Many are first-time borrowers

- Male family members often handle financial decisions

- Women entrepreneurs in informal sectors rarely use credit cards or loans.

What banks won’t tell you:

- You can build your score using small loans, digital lending platforms, or microcredit options.

- Missed payments, even on old mobile EMIs, can negatively impact your credit score.

3. Gender Bias in Lending Is Subtle but Real

Banks may not openly acknowledge it, but gender bias undoubtedly influences loan approvals. Research shows that women are offered:

- Lower loan amounts

- Shorter tenures

- Higher documentation requirements

What this looks like:

- “Get your husband to co-sign, it will improve your chances.”

- “Can you run this business by yourself?”

- “What if you go on maternity leave?”

Business Loan Tips: Push back respectfully. Ask for the reason in writing if your loan is rejected or reduced.

A report by the International Finance Corporation (IFC) noted that female borrowers are 96% more likely to repay on time, yet are perceived as “riskier.”

4. You’re Expected to Know the Process, But No One Teaches You

For many women, this is the first time applying for a business loan, and the system offers very little support.

Banks don’t explain:

- How to calculate loan EMIs

- How interest rates work (flat vs reducing)

- What documents matter

- How does business registration impact loan size

Must-have documents:

- KYC: Aadhaar, PAN

- Business Proof: Udyam Registration / GST / Shop License / Receipts

- Income Proof: Bank statement for last 6–12 months

- Credit Report: Download for free from CIBIL/Experian websites

Business Loan Tips: Prepare a loan file that includes your business pitch, monthly income estimate, and purpose of business loan, even if not explicitly asked.

5. Loan Products Are Not Designed for Women-Led Businesses

Most women-led businesses are:

- Home-based

- Seasonal or cash-heavy

- In sectors like tailoring, food, beauty, or handicrafts

But loan products are:

- EMI-based with fixed monthly payments

- Require consistent cash flow

- Often have high processing charges or strict penalties

Business Loan Tips: Look for lenders who understand small-ticket needs and offer flexibility in repayment or step-up repayment options.

What women entrepreneurs need:

- Working capital loans with low ticket sizes (₹10K–₹ 1 L)

- Customised repayment based on business cycles

- Digital application support

6. Post-Loan Support? Missing in Action

Once the loan is disbursed, many women feel left in the dark.

No one explains:

- When and how to repay a loan faster

- How late fees work

- How to maintain a good repayment history

- How to become eligible for top-up loans in the future

Business Loan Tips: Before disbursement, ask your lender about repayment planning, grace periods, and top-up eligibility.

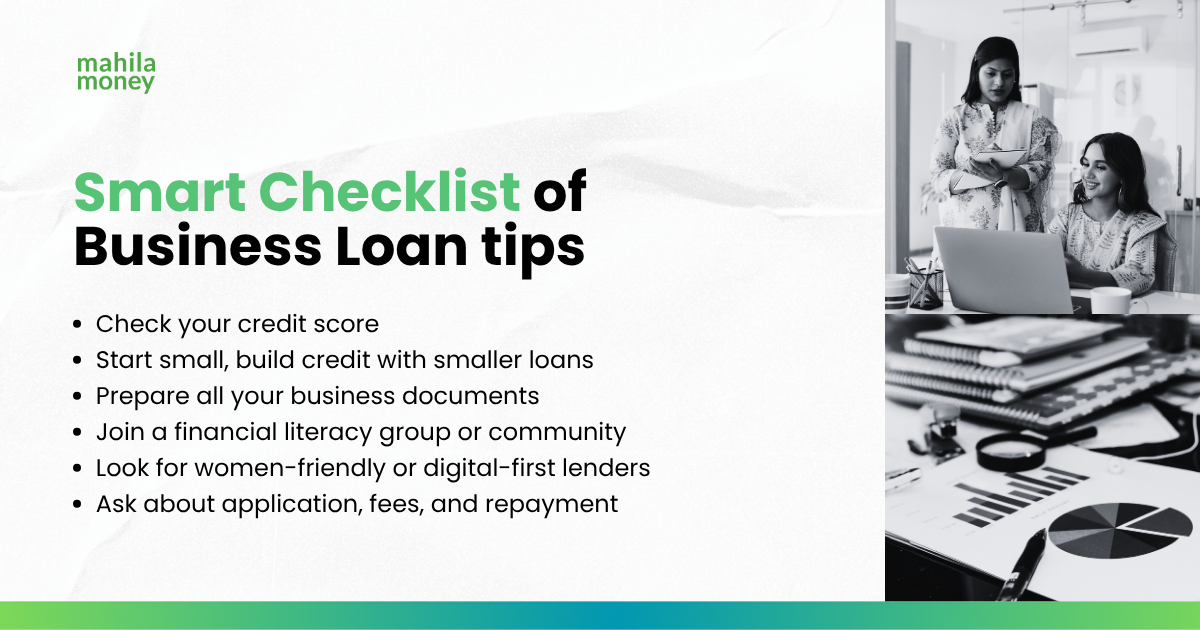

So, What Can Women Entrepreneurs Do Differently? Below are some business loan tips:

How Mahila Money Is Supporting Women Entrepreneurs

At Mahila Money, we believe business loans should come with support, clarity, and confidence, not confusion.

Here’s how we’re helping:

1. One-on-One Loan Support:

The Mahila Money team helps you understand:

a. What loan suits your business?

- 10K-1L – My Business Starter Loan

- 1L-5L – Grow My Business Loan

- 5L-25L – Sky Is The Limit Loan

b. How to prepare the proper documents

c. How to improve your credit profile

Mahila Money Loan Open House – Mon to Fri, 12–12:45 PM

Join our free daily session where a live loan expert answers your queries, checks eligibility, and guides you step-by-step.

Educational Resources

From checklists to guides, videos to Q&As, we’re creating straightforward, valuable content so women can take informed loan decisions.

Community-First Approach

Our app allows you to ask, learn, and grow, with 1000s of women sharing their experiences and advice daily. Your business deserves more than a loan. It deserves a support system.

Download the Mahila Money app today and start your loan journey with the guidance you’ve always needed.

Conclusion: Ask More. Learn More. Expect More.

Banks won’t always tell you the whole story, but that’s why you need to ask the right questions.

Loans are powerful tools but only when used right.

So, prepare smartly, speak confidently, and choose lending partners who see you, not just your documents.

Lets #JiyoApneDumPe

Read more:

How to Apply for GST Registration Online: A Step-by-Step Guide for Small Businesses

5 Smart Tips to Build Emergency Fund for Your Small Business

What Licenses Do You Need to Run a Cloud Kitchen in India? A Guide for Aspiring Foodpreneurs

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money

Bohot helpful tips hain! Especially un women ke liye jo loan lene se darte hain. Ab confidence ke saath apply kar sakti hoon. 👏