Starting your first business? Or already running a business? The excitement, the ideas, the Instagram-ready packaging, and the first few customers, it’s a high that’s hard to match, right? But hidden underneath every small business story is the quiet, consistent pressure of managing money. And that’s where budgeting tips for first-time entrepreneurs come in, not the kind you find in finance books, but the ones no one tells you until it’s too late.

If you’re a new entrepreneur trying to figure out where your money is going, then this guide is for you.

Why Budgeting Feels Tough in the Beginning

Let’s face it, you didn’t start your business to become an accountant. But suddenly, you’re tracking orders, paying vendors, dealing with delivery mishaps, and wondering how much you earned this month. Most first-time entrepreneurs don’t come from finance backgrounds, and even fewer have any formal training in budgeting for small business success.

Money feels unpredictable. One week, sales are booming; the next, things are silent. You feel tempted to spend on the “right” branding or the trendiest packaging. There’s no roadmap, only decisions that need to be made right now.

Your First Budget: Keep It Simple

If you’re unsure how to create a budget for a new business, don’t worry. Start with this three-column system: Income, Expenses, and Cash Flow. This basic system helps you understand how much you’re earning, where it’s going, and what’s left (or not).

Separate your fixed costs, like rent, staff salaries, and internet bills, from variable costs like marketing spends, packaging, shipping, etc. The latter will change month to month, so leave room for flexibility.

And here’s a powerful startup budgeting tip: Always underestimate your income by 20%. That’s your cushion against a slow sales week or sudden cancellations.

7 Budgeting Tips For First-Time Entrepreneurs

Making smart decisions early on and building habits will serve you as you grow. Here are seven practical, often-overlooked budgeting tips for first-time entrepreneurs that go beyond just expense tracking..

1. Don’t Burn It All Too Soon – Start Lean, Then Scale

Your first three months in business are your learning zone. You are busy understanding customer behaviour, product performance, and setting pricing patterns. This is not the time to indulge in complete branding, bulk inventory, or flashy ads. One of the best startup budgeting tips for first-time entrepreneurs is to spend cautiously until you see consistent demand. Starting lean gives you room to expand without burning through your cash reserves. This is one of the smartest tips for managing startup costs – start small, spend wisely, and observe before scaling.

Track Every Rupee – The Tiny Expenses Add Up

Think ₹20 for a courier or ₹500 on ad boosts don’t matter? Well, they do! Untracked small spends are the silent killers of a business budget. Use free or low-cost tools like KhataBook, Zoho Books, or even a Google Sheet to log every transaction. When done right, budgeting for small business success starts with accurate visibility of your money flow.

3. Build a Safety Net – Emergency Funds Are Non-Negotiable

Cash flow disruptions are common in the first year. Sales dip, clients delay payments, or raw material costs shoot up. That’s why it’s important to build a buffer, ideally two months’ worth of essential expenses. This isn’t extra, it’s survival strategy. For first-time entrepreneurs, budgeting without an emergency fund is like driving without brakes.

4. Stop Mixing Business and Personal Money – It’s Hurting You

One of the most common budgeting mistakes new entrepreneurs make is using one bank account for both business and personal expenses. It makes tracking impossible and tax filing chaotic. Open a separate business account from day one. Separating personal expenses from business brings financial clarity, simplifies audits, and is a big plus when applying for small business loans later.

5. Allocate for Learning – Budget for Trial, Error & Experiments

Not every marketing campaign will work. Not every product will sell. And that’s okay, as long as you plan for it. Smart budgeting tips for first-time entrepreneurs should set aside 5–10% of your budget for experiments. Whether it’s trying a new ad strategy, testing samples, or launching a new design, this money keeps your innovation alive without affecting your core operations.

6. Don’t Set and Forget – Review Your Budget Monthly

Your business won’t look the same in April as it did in January. So why should your budget? A common small business budgeting tip that’s often skipped is to set a reminder every month to review your income and expenses. Spot the leaks, adjust goals, and keep improving. Waiting for year-end to fix your money issues is too late.

7. Hidden Costs Are Real – Identify Them Before They Pile Up

Have you factored in payment gateway fees? What about product returns, packaging damage, cancelled deliveries, or festive discounts? These hidden costs can silently eat into your profits. One of the top budgeting tips for small business owners is to audit your complete process monthly and list down every indirect cost you’re incurring. Awareness is the first step to prevention.

These budgeting tips for first-time entrepreneurs are not just about saving money; they’re about making smarter decisions with money. No matter how unpredictable your monthly income may be, these habits help you build a business that’s not just surviving, but steadily growing.

Apply For a Business Loan

What No One Tells You About Budgeting

Most people think budgeting is about maths. In reality, it’s about mindset. It’s about choosing what not to spend on, even when the money is there. It’s about slowing down when everyone else is scaling up.

No one tells you how emotional business money decisions can be. You want your Instagram to look polished. You want to say yes to every customer request. You want to feel like a “real” business. And sometimes, that pressure leads to bad budgeting.

Meenal, who runs a stationery brand from Gurgaon, said it best:

“In my first year, I spent more money looking like a brand than building one.”

One of the most underrated budgeting mistakes new entrepreneurs make is copying what others are doing, without checking if it makes sense for their business stage.

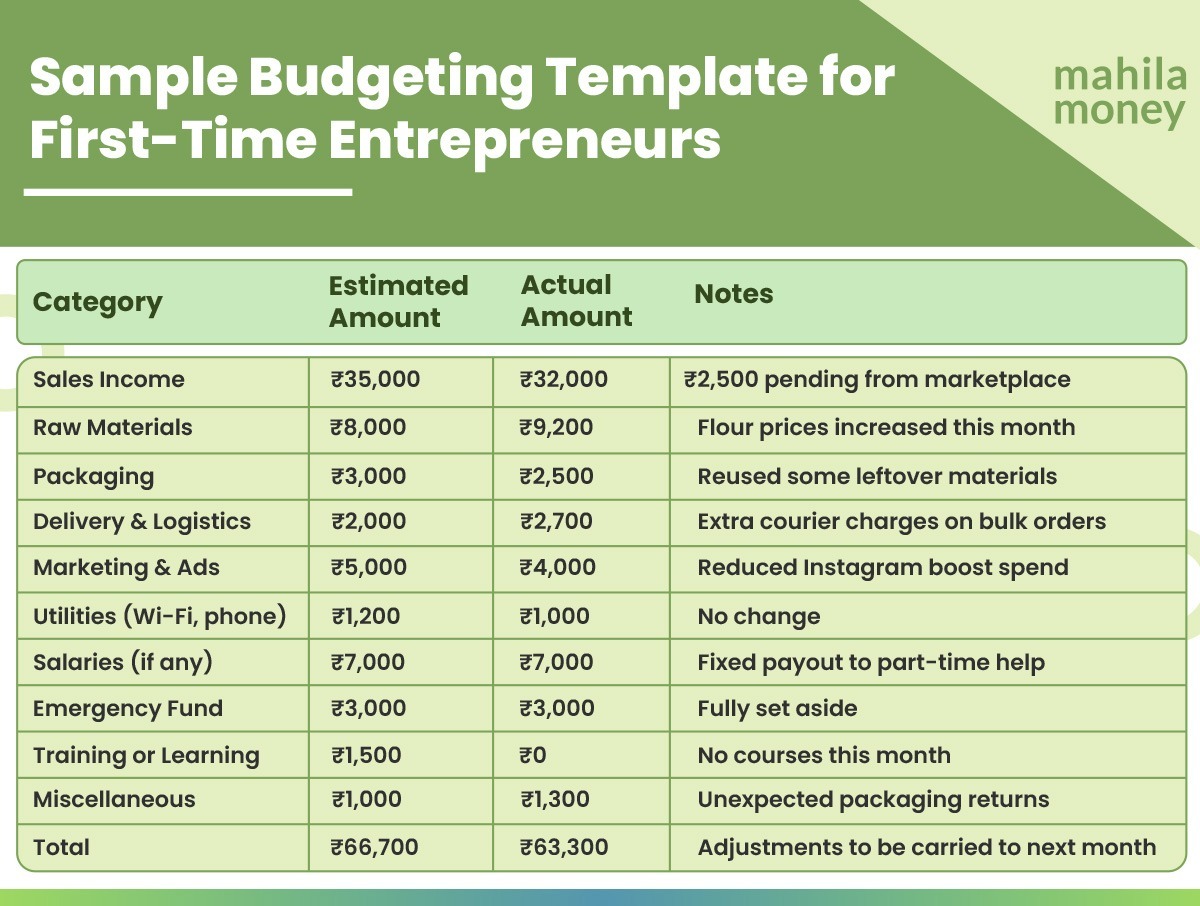

A Simple Budgeting Template to Get You Started

Here’s a basic format to create your budgeting guide for entrepreneurs. You can do this in any notebook or Excel sheet.

This is your live document. Check in with it weekly. Over time, you’ll be able to plan better, predict better, and save better.

Final Thoughts: Budgeting is a Habit, Not a One-Time Task

If there’s one truth every first-time entrepreneur must accept, it’s this: budgeting isn’t optional. It’s not just for keeping things running, but for helping you make decisions with clarity and confidence.

Always remember, your budget isn’t there to limit your vision but to help you execute it without falling into debt or burnout. So take 30 minutes this week, sit with your numbers, and give your business the financial attention it deserves.

Read more:

How to Price A Product or Service to Stay Profitable

10 Ways How To Spend A Business Loan Wisely

How to Build a Strong Credit Score Before Applying for a Business Loan

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money

Bilkul sahi tips diye hain! 🤩 Jo log pehli baar apna business shuru kar rahe hain, unke liye yeh budgeting hacks bahut kaam aayenge. Smart planning se hi long term success milti hai. 💡