Running a small business means making smart, timely decisions, especially when it comes to spending money. One common dilemma most entrepreneurs face is: Should I buy in bulk and save per unit, or should I take goods on credit and preserve cash flow?

From raw materials and packaging to inventory restocks and festive season supplies, small business owners constantly juggle between bulk discounts and the flexibility of credit. So, which approach works better and when?

Let’s break it down.

What Does Buying in Bulk Mean?

Buying in bulk refers to purchasing larger quantities of goods or raw materials at once, often directly from a wholesaler or manufacturer, at a discounted rate. For small business owners, this can look like buying 500 bottles of oil for a soap-making business, or 100 kilos of fabric for a tailoring unit.

The goal? Reduce the cost per unit and improve profit margins.

But bulk buying isn’t just about saving money. It’s also about planning, predicting demand, and managing inventory. If you are a small business owner, dealing with high-volume sales or fast-moving products, buying in bulk could offer a long-term advantage.

What is Buying on Credit?

Buying on credit for small business, on the other hand, allows you to purchase goods today and pay for them later, usually within 30 to 60 days. This could work well with a supplier, through a credit line, or even using a small business loan or credit card.

For many small business, this helps maintain cash flow, fund operations, and meet seasonal demand without exhausting savings.

Buying on credit may sound good for small businesses! But make sure to manage payments wisely, avoid pitfalls like late fees and high interest, ensuring that this flexibility remains a valuable asset.

Buying in Bulk: When It Works and When It Doesn’t

Buying in bulk for small business is suggested only when your business is in a growth phase or experiences consistent demand. It’s better suited for products with long shelf life, requiring minimal storage, and reliable customer turnover.

What Are the Benefits of Buying in Bulk?

- Lower cost per unit

- Reduces frequency of orders and logistics costs

- Shields you from sudden price hikes or supply shortages

Things to Consider Before Buying in Bulk:

- Do you have enough storage space?

- Can your inventory stay fresh or usable over time?

- Will the stock move fast enough to avoid deadstock or loss?

Buying on Credit: Smart Leverage or Costly Risk?

Credit can offer a solid cushion when your cash reserves are low or tied up in ongoing projects. It also helps build a credit history, which can improve your chances of securing a business loan in the future.

What Are the Benefits of Buying on Credit?

- Preserves working capital for other expenses

- Allows flexible payment after sales start coming in

- Builds financial discipline and creditworthiness

Risks to Watch Before Buying on Credit:

- Interest rates or late payment penalties

- Unpredictable sales may delay repayment

- Supplier terms may not always be negotiable

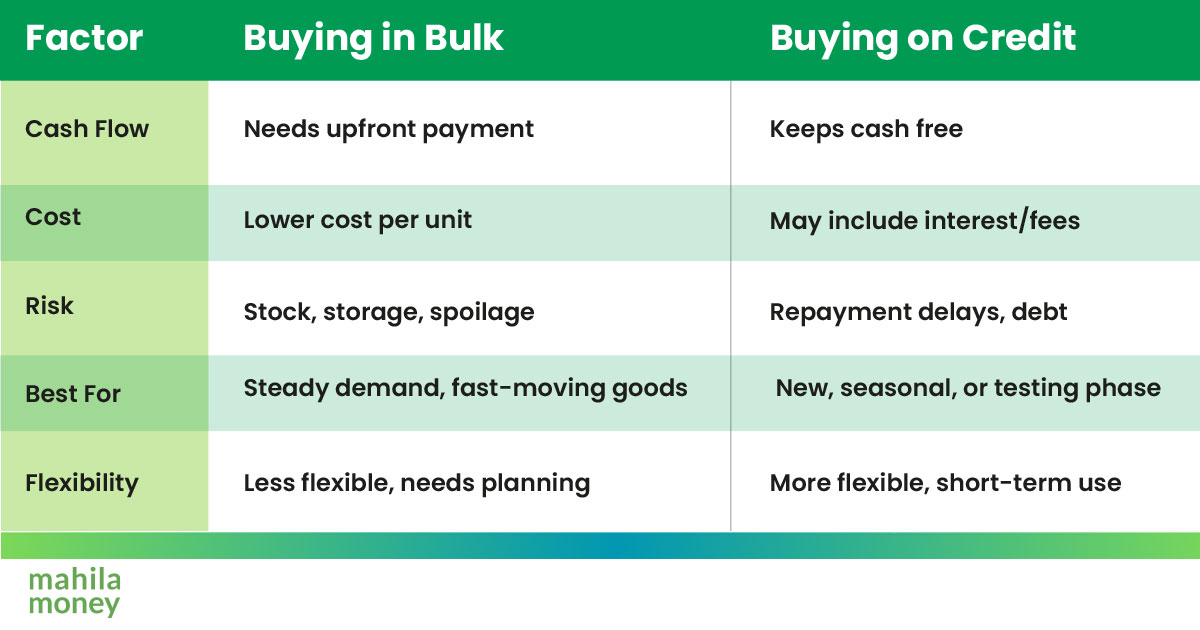

Buying in Bulk vs. Credit: A Quick Comparison

How to Decide What’s Right: Do the Money Math + Supplier Strategy + Risk Check

Before jumping into any purchasing decision, sit down and do a simple cost-benefit analysis.

For instance:

If you’re buying 1,000 units of eco-friendly containers at ₹8 per unit in bulk vs ₹10 on credit with 5% interest, you’re potentially saving ₹2,000–₹3,000 only if you sell all the stock quickly and have space to store it.

Remember: Buying in bulk isn’t automatically “cheaper” if your products sit unsold.

Ask Your Supplier the Right Questions

The best way to choose between bulk and credit is to talk to your vendor. Don’t shy away from asking questions:

- Do you offer discounts for upfront bulk orders?

- Are credit terms interest-free or include hidden charges?

- Can I combine multiple items in a bulk order?

- What’s the penalty if I delay credit repayment?

- Is there a return policy or buy-back on unsold inventory?

Getting answers will only help you avoid future risks and build a transparent vendor relationship.

Red Flags to Avoid (Whether Bulk or Credit)

No matter what option you choose, watch for these traps:

- Buying seasonal or trend-based stock in bulk

- Not tracking stock or sales velocity

- Taking credit without a repayment plan

- Ignoring fine print in supplier agreements

- Mixing personal savings with credit repayments

Your decision should match your business stage, not your fear of missing out.

How to Choose What’s Right for You: 5 Key Questions

Ask yourself these before committing:

- Do I have predictable, recurring demand?

- Can I store and manage large quantities?

- Will I sell the bulk stock within 30–60 days?

- Can I repay credit even if sales slow down?

- Have I explored all supplier negotiation options?

Often, the smartest choice lies in a mix of both, buying in bulk for high-moving products and using credit for limited seasonal runs.

FAQs: Buying in Bulk vs. Credit

1. Is buying in bulk cheaper for small businesses?

Yes, it typically lowers your cost per unit, but only if inventory moves fast and doesn’t expire or get damaged.

2. When should I choose credit over bulk purchases?

Choose credit when cash is tight, or you expect upcoming sales (like festive seasons) and want to manage short-term costs smartly.

3. What are the risks of bulk buying for small businesses?

Overbuying, product spoilage, lack of storage, and deadstock are common issues, especially for newer businesses.

4. Does buying on credit affect my business credit score?

Yes. Timely repayment builds your credit history. Any delayed or defaults can negatively affect your credit profile.

5. Can I use a business loan to buy in bulk?

Absolutely. Many small business owners use working capital loans to bulk purchases and secure better margins.

6. How do I check if a supplier’s credit terms are fair?

Ask about the payment deadline, interest (if any), late fees, and if the terms can be adjusted. Get everything in writing before agreeing.

7. Should I always prefer buying in bulk if I have funds?

Not always. Evaluate demand cycles, stock movement, and your growth plans. Smart buying is about timing and fit, not just money.

Both buying in bulk and buying on credit for small business can be powerful tools in your business toolkit, but only when used thoughtfully. What matters most is understanding your cash flow, sales cycles, and vendor relationships.

Sometimes, a mix of both works best. Bulk buy your fast-moving items, and use credit to test new lines or cover temporary gaps.

Need help with working capital or credit options?

Download the Mahila Money app and explore our flexible business loan solutions tailored for women-led ventures.

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money

Bulk mein kharidna smart business decision hota hai 💡

Savings bhi hoti hai aur tension bhi kam! Bahut helpful tips mile iss blog se 🙌