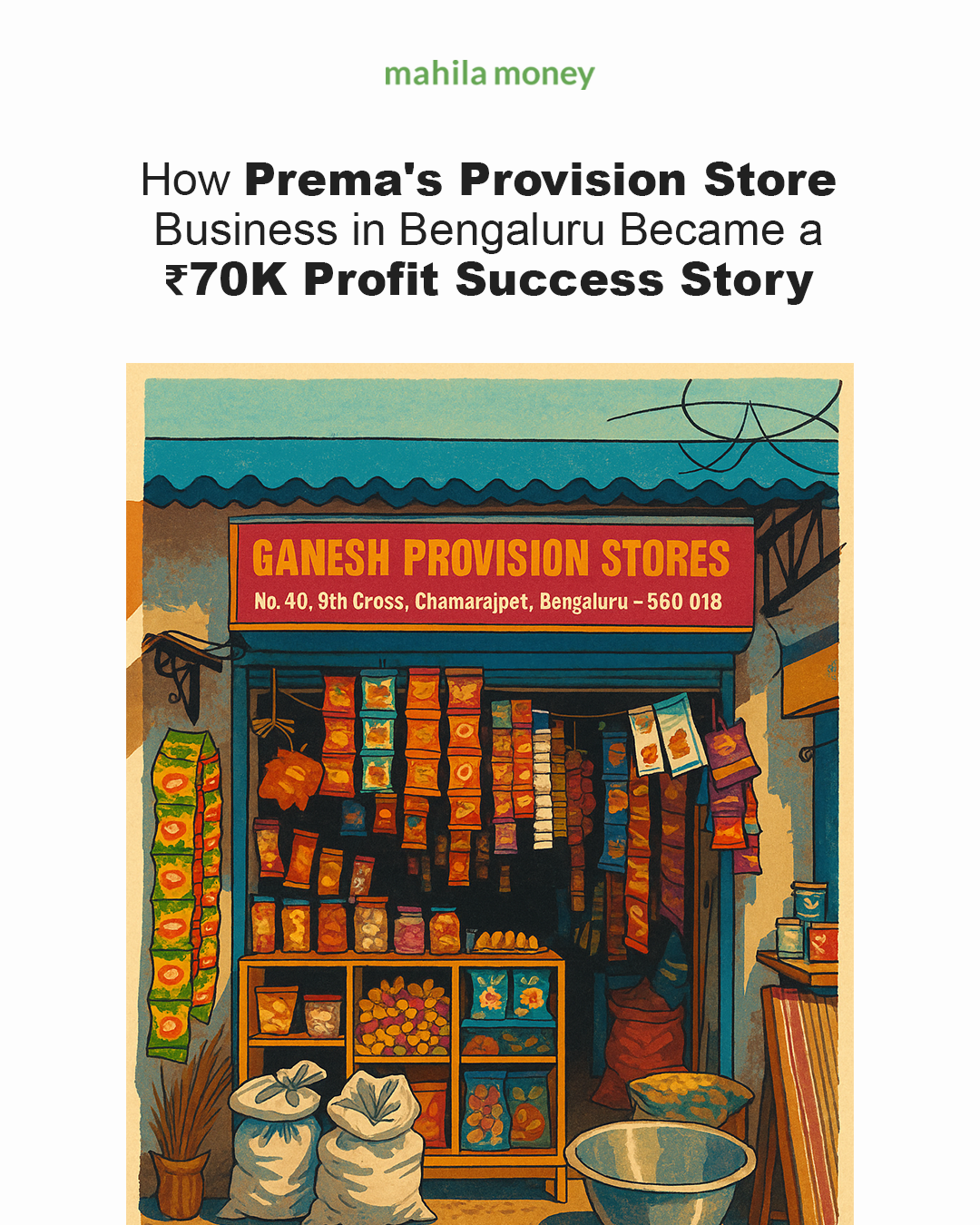

There’s a tiny shop tucked inside a quiet lane in Chamrajpet, Bengaluru. The paint is fading, the shelves are stacked with soaps, toffees, and everyday groceries, and the owner Prema greets each customer with a smile that’s been shaped by years of quiet struggle.

Prema started her provision store business in the year 2023, right after she turned 48 years old. She belongs to the growing force of women entrepreneurs from India’s Tier II and III cities, who now make up 96% of the segment, as per a recent Tide India report. Like 31% of other women-led businesses across the country, she chose a familiar path: opening a neighbourhood general store. But she’s doing it with a digital twist – over 50% of her customers pay online, a sign of how the local is quietly going digital.

Apply For a Business Loan

This is not a story of flashy success or viral headlines. It’s a real woman entrepreneur story of late beginnings, steady hands, and a small business that grew quietly and consistently into a reliable daily needs shop for her community. From managing stock on her own to ensuring every child leaves with a toffee in hand, Prema’s journey is an inspiring small business success story. One of many unsung women in the retail grocery business who remind us that growth doesn’t always need to be big, it just needs to be yours.

Starting a Provision Store Business in Her Late 40s: How it all started

Prema never imagined she’d become a provision store business owner at 48. She was a homemaker for most of her life, running the household quietly, as many women in traditional Indian families do. But it was her daughter, Chaithra , who saw something more in her.

“Amma, you know how to run a house better than anyone. I’ve watched you budget, plan, and manage everything. That’s business,” Chaithra had told her one evening, over a cup of coffee.

At first, Prema laughed it off. “What will people say?” she asked. “Who starts a provision store business at my age?”

But Chaithra didn’t give up. She made lists of items they could sell, found a tiny space in Chamrajpet near their home. It was the push Prema didn’t know she needed.

“She told me, ‘We’ll run it together, Amma. You take care of the customers. I’ll handle the rest.’ That gave me courage,” says Prema.

With Chaithra by her side, she took the leap. In just a few weeks, the shelves were stocked with rice, pulses, oil packets, and soaps – essentials every household needed. It wasn’t fancy, but it was hers.

Today, it’s not just a daily needs shop – it’s the beginning of Prema’s own small business success story, powered by love, late bloom, and the belief that it’s never too late to start.

“This shop gave me new energy. I didn’t know I had it in me,” she says with a smile.

Her journey has since become a personal women entrepreneur story, shifting norms in her community and inspiring other women to see the potential in everyday dreams.

A Women-Led Business in India That’s Gaining Respect

When Prema first set up her shop, Ganesh Provision Stores – she was met with doubt.

“People would ask, ‘Why now?’ Some even laughed, saying this kind of work isn’t for women my age,” she recalls.

But today, things have changed. Customers know her by name. Many call her “akka” with affection. Some women in her neighbourhood now seek her advice on running a women-led business in India.

“They ask how I managed. I just smile and tell them, ‘Start small, but start.'”

Her shop has become more than a store; it’s a trusted source for daily needs that anchors the community.

How a Business Loan for Women Helped Prema Expand

In the early days, Prema’s shop Ganesh Provision Stores had limited stock. She could only keep basic essentials. Popular items like fancy snacks, ready-to-eat mixes, and branded toiletries were beyond her budget.

“Some customers would ask for items I didn’t have. I had to tell them, ‘Come back next week.’ But they didn’t always return,” Prema recalls.

That changed when she applied for a business loan for women. It was her first brush with formal finance.

“I was nervous about the paperwork. But Chaithra helped me through every step. She said, ‘This is what will take us to the next level, Amma.’

With a 50K loan in hand, Prema expanded her inventory just in time for the festive season. Rows of colorful packets lined the shop, rangoli colors, pooja items, Diwali sweets, gift packs. For the first time, her shop looked full.

“That Deepavali, I saw my shop glowing, literally and emotionally. Customers came in with their kids, asking for everything from laddus to lights. I felt like a real businesswoman.”

Her shop, once known as a basic daily needs shop, transformed into a buzzing retail grocery business. Profits started increasing steadily. Regular customers turned loyal. Some even started calling her “Prema Aunty Stores.”

“One customer said, ‘We don’t go to the supermarket anymore. You have everything we need.’ That made my day.”

The grocery shop profit story wasn’t just about money – it was about recognition, dignity, and identity. Prema had gone from being “someone’s wife and a mother” to being a women-led business owner in India, running a full-fledged provision store business in Bengaluru.

The Impact of the Business Loan: Growth, Stability, and Digital Confidence

For Prema, the business loan for women wasn’t just about stocking shelves. It was about scaling confidence.

Before the loan, her profits hovered around ₹40,000 a month. Six months after the loan, her monthly net profit rose by nearly 40%, consistently reaching between ₹60,000 and ₹70,000. That’s a powerful jump for a provision store business run from a small corner in Bengaluru.

“Now, I can buy in bulk, restock faster, and say ‘yes’ to customers more often,” she says, standing behind her well-organised counter.

Her average monthly revenue over the last six months sits comfortably between ₹1,00,000 and ₹1,50,000. With fixed expenses of only ₹19,000, Prema runs a lean, profitable setup.

What’s even more impressive? Over 50% of her sales now happen via online payment modes, a combination of UPI and account transfers. This not only ensures steady bank credits but also makes her business digitally visible, reducing cash risk and improving her ability to access formal credit.

“Some younger customers don’t even carry cash. They just scan and go. I used to be afraid of QR codes, now I check them like a pro,” she laughs.

The consistency in her revenue, averaging ₹89,753 per month via bank transactions, also made her a stronger candidate for financial products in the future. Her shop is Udyam registered, and the family has a stable income with three earners, reducing the pressure on her to contribute to household expenses. This gives her space to expand her small business, experiment with new items, and continue growing her retail grocery business.

Yes, competition from nearby stores exists. But customers keep coming back to Prema’s provision store because they trust her, talk to her, and feel seen.

“Now the same people who doubted me come to ask, ‘How did you manage to do all this?’ I smile and tell them, ‘One customer and one packet at a time.'”

Counting Profits Beyond Just Money

While Prema’s earnings have improved, she now contributes confidently to household expenses – her biggest gain is something else.

“I feel important,” she says simply. “Earlier, everything I did was invisible. Now my children ask me for business advice!”

Her shop might be modest, but it tells a powerful grocery shop profit story. It’s proof that a woman with limited means and no prior business background can still thrive in the provision store business.

The Real Face of Women-Led Small Businesses in India

Prema’s journey is a reminder that not every small business success story starts with investors or Instagram followers. Sometimes it starts with one woman, one shelf of goods, and a belief that she can do more.

In a country where millions of women dream of starting their own ventures, stories like Prema’s matter. Her women entrepreneur story shows us that age, background, or education need not be barriers to building a meaningful, sustainable provision store business.

Read more success stories:

How a Teacher Turned Fashion Entrepreneur Grew Her Small Business with Mahila Money

How a Single Mother Entrepreneur Found Her Calling as Dr. Mital, the Skin Doctor

How Tehseen Built Three Businesses with Small Business Loans for Women Entrepreneurs

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money.

Such an inspiring story!

Prema ji’s determination and hard work show that with confidence and the right support, no dream is too big.

Platforms like Mahila Money truly empower women to not just dream, but also achieve.

Wishing her even more success ahead – her journey will definitely inspire many more women! 💪🌸

Thanks, Lovisha. Glad you liked it.