The glass counter gleams under the soft morning sun. Behind it, Harsha Rani sits with her warm smile, surrounded by neat rows of lipsticks, soaps, and skincare bottles that line every shelf of Jot Cosmetic Store in Hisar, Haryana. From a small speaker tucked near her counter, Diljit Dosanjh’s voice fills the room, a regular companion to her busy mornings.

“Diljit keeps me company when work gets long,” Harsha smiles. “His songs make even business feel like fun.”

It’s hard to believe this bright little shop started as a single shelf in her living room just six years ago. Today, it’s a full-fledged cosmetic store that draws women from nearby villages and towns. Her customers trust her for her warmth as much as for her recommendations – Lakmé for daily wear, Huda for special occasions, and always a little confidence to go with it.

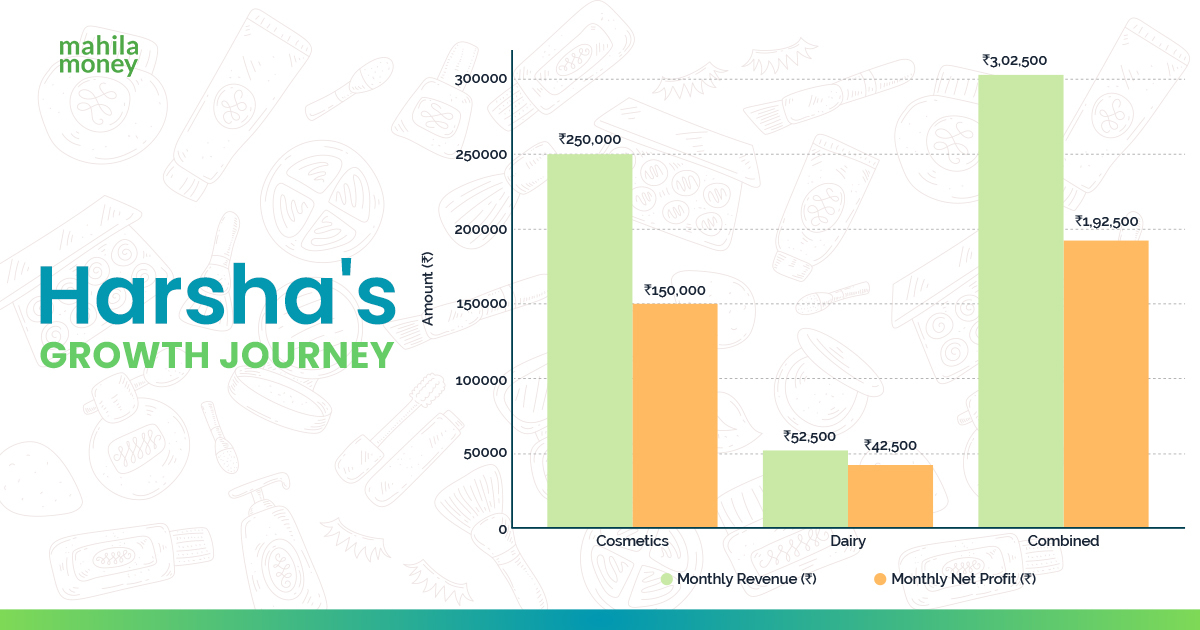

At 25, Harsha, a young entrepreneur, has built a thriving business that earns her over ₹1.5 lakh a month, and she’s not stopping there. With the festive season approaching, she’s taking a bold step forward: business expansion beyond beauty into an entirely new category: dairy.

From Stitching Suits to Building a Brand

Before the shelves of lipstick and liners, Harsha’s days were filled with fabric and thread. She stitched salwar suits for pocket money after her college classes.

“Back then, I didn’t realise it, but I was learning business,” she says. “Dealing with customers, keeping accounts, delivering on time, that was my first training.”

When she got married, she wanted to do something of her own. With small savings and her husband’s encouragement, she began selling cosmetics from home. Slowly, her little corner turned into Jot Cosmetic Store, now one of the most loved shops in her area.

Building Credit, Building Confidence

Over time, Harsha formalised her business, registering under Udyam, filing her ITR, and applying for a business loan. “I’ve always handled my money carefully,” she says. “Even a small loan can open big doors if you use it wisely.”

When Harsha applied for her first business loan, she was new to credit, had no prior borrowing history, and no CIBIL score. But that didn’t stop her. With a clear business plan and strong repayment intent, she secured her first loan and began her credit journey.

Today, she’s not just earning profits, she’s also building a strong financial history. Each on-time EMI adds to her CIBIL score, making her eligible for larger loans in the future. For first-time borrowers like Harsha, that’s a big deal. It marks the beginning of long-term financial credibility and business independence.

“Earlier, I didn’t even know what a credit score was. Now I check it every month, it feels great to see it improving!” she laughs.

That financial discipline laid the foundation for her next step, expanding from cosmetics into dairy.

A Smart Business Expansion

Most would hesitate before venturing from lipsticks to litres of milk. But Harsha saw opportunity where others saw risk.

“In our area, no one runs a proper dairy,” she explains. “Milk comes from far-off places, and sometimes it’s not fresh. I thought, if people trust me for kajal and cream, they’ll trust me for milk and paneer too.”

For Harsha, business expansion wasn’t about changing her identity; it was about growing her income smartly. She plans to use her loan for two things:

- Stocking up her cosmetic inventory to meet festive demand

- Saving for her first cow, laying the groundwork for her dairy venture

With milk selling at ₹70 per litre and paneer at ₹350 per kilo in her area, Harsha knows the margins are promising. And because her household expenses are shared with her husband, she has room to take calculated risks.

Her business philosophy is simple: diversify with logic, not impulse.

“If my customers trust me for kajal and creams, they’ll trust me for quality milk too,” she says confidently. Harsha is turning this second venture into an additional ₹42,500 monthly profit. Her business expansion journey shows that smart diversification can double the impact of a small business loan.

Riding the Festive Wave, Timing Is Everything

In India, festivals mean business. From Teej to Diwali, every celebration brings a surge in demand for makeup, sweets, and everything in between.

“During Diwali and Karva Chauth, my store is packed,” Harsha says, smiling. “Lipsticks, mehendi, gift boxes, sab bikta hai. And during the same time, paneer sells like gold!”

That’s when the idea of business expansion clicked perfectly. By using her loan to top up festive stock and prepare for her dairy setup, she’s ensuring her investments multiply, one festive season at a time.

“It’s like playing both sides of the coin,” she says. “Beauty outside, health inside – everyone wins!”

Harsha’s Business Lessons for Every Woman Entrepreneur

Harsha’s journey is not just a story of ambition; it’s a case study in how women entrepreneurs can expand their small business strategically.

Here are her biggest takeaways, in her own words:

1.Diversify smartly

Don’t abandon your first business; build the second one to support it. Cosmetics gave me stability; dairy will give me growth.

2. Use the trust you’ve built

My cosmetic customers will be my first milk buyers. Loyal customers are your biggest marketing tool.

3. Time your business expansion right

Festivals are when people spend the most. Stock smartly and make your products part of their celebrations.

4. Understand your finances

My Mahila Money productive loan taught me how credit can help women entrepreneurs build credibility for bigger opportunities.

5. Family support is capital too

My husband shares household expenses, which is my biggest business advantage.

A Future Full of Dreams

By 9 p.m., as the day winds down, Harsha sits counting her earnings. Her assistant, Navneet, closes the shutters while her kids play in the courtyard. The soft notes of another Diljit Dosanjh track fill the air.

“Work feels lighter with music,” Harsha grins. “Running a business from home isn’t easy, but you have to make it work.”

Her next dream? A bigger cosmetic store in the city, with a dairy section beside it, selling fresh milk and the best lassi in town.

“Why not?” she smiles. “People will come to me for beauty and stay for health. That’s what true business expansion means.”

From confidence to courage, Harsha Rani’s story is a masterclass in business expansion done right. Through festive demand, community trust, and fearless diversification, she’s proving that success doesn’t come from staying still – it comes from daring to grow.

Read more:

How Prema’s Provision Store Business in Bengaluru Became a ₹70K Profit Success Story

How a Single Mother Entrepreneur Found Her Calling as Dr. Mital, the Skin Doctor

How Tehseen Built Three Businesses with Small Business Loans for Women Entrepreneurs

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money