Learn how to build a strong credit score before applying for a business loan. Follow these practical tips to boost your credit profile and improve loan approval chances for your small business.

When it comes to business loans, the rejection rate for women-owned businesses is nearly twice that of men, even though studies show that women are more disciplined in their repayments. In most cases, it is observed that when women are not the primary borrowers in many households, they often ensure that repayments are made on time. They also work hard to maintain social networks that keep informal borrowing channels open.

Despite this, 47% of women entrepreneurs in the MSME sector struggle to secure financial credit. Why is it still so challenging for women entrepreneurs to access formal credit? The answer lies partly in building a strong credit profile—something that can significantly tilt the scales in favour of women-led businesses. If you’re a woman entrepreneur looking for the answer to “how to build a strong credit score before applying for a business loan”, we’re here to help.

What is a Credit Score, and Why Does It Matter?

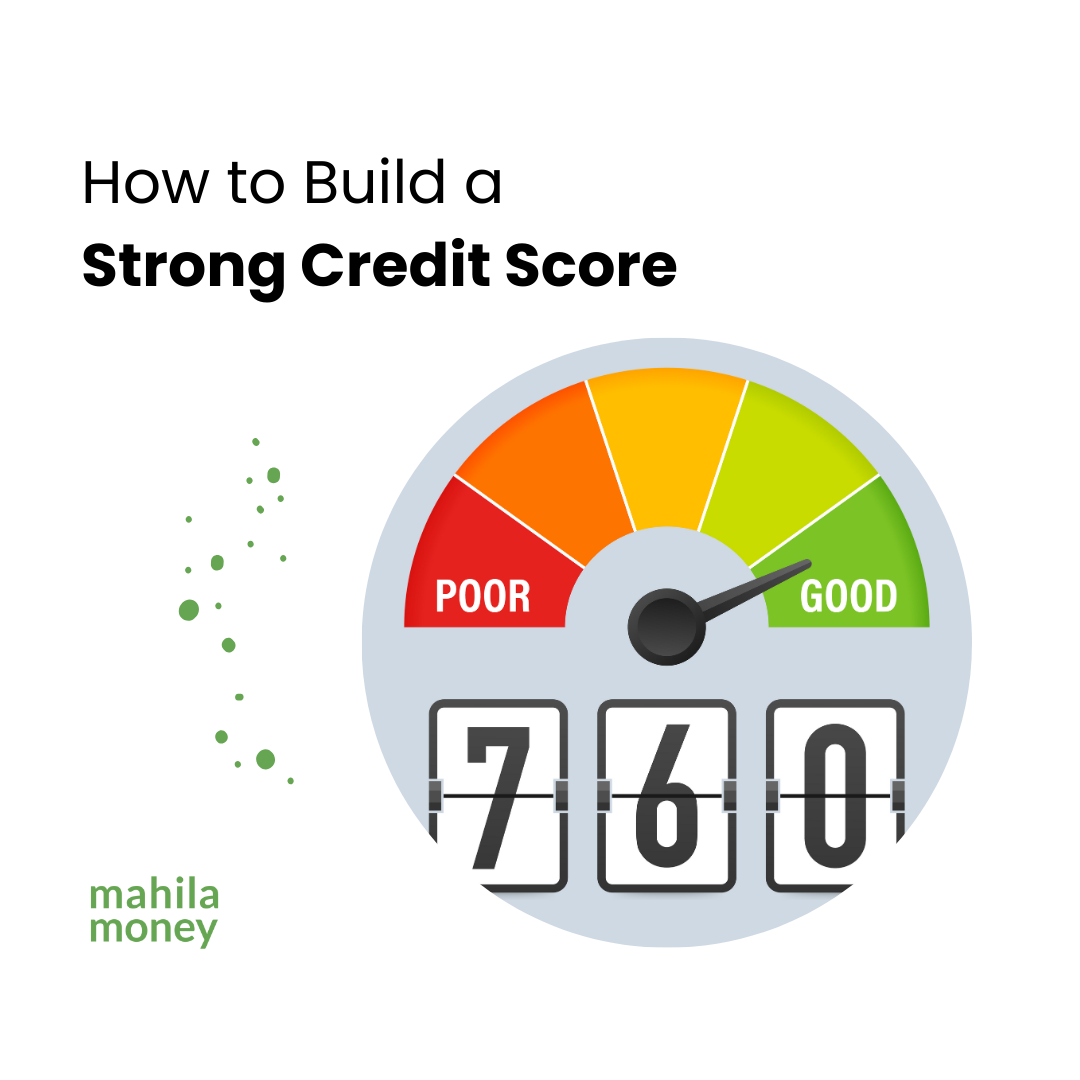

If you have been thinking “Why is my loan getting rejected?” then your low credit score might be one of the reasons. A credit score is a three-digit number that represents your creditworthiness. Ranging from 300 to 900, a score above 700 is generally considered good in India. Lenders use this number to assess how likely you are to repay a loan. A higher credit score increases your chances of loan approval and shows lenders that you are a trustworthy borrower.

Why is a Good Credit Score Essential for Business Loans?

A strong credit score is crucial for women entrepreneurs, especially those running small businesses. It tells lenders that you are reliable and responsible with credit. Given women’s higher loan rejection rates, having a strong credit profile can be a game-changer in gaining access to necessary funds for growth.

9 Tips On How To Build A Strong Credit Score Before Applying for a Business Loan

Now, let’s dive into some actionable steps to strengthen your credit profile before applying for a business loan.

1. Check Your Credit Score Regularly

Your credit score is the backbone of your financial health. It’s important to monitor it by checking it regularly through trusted agencies like CIBIL, Equifax, Experian, or CRIF High Mark.

Quick Tip: Set a reminder to check your credit score every three months. Regular checks can help you spot any mistakes or issues early on so you can fix them quickly.

How to Check Your Credit Score for a Business Loan:

Step 1:

Visit a Trusted Credit Bureau: Go to a site like CIBIL, Equifax, Experian, or CRIF High Mark.

Step 2:

Enter Your Details: Fill in basic information like your name, PAN, and contact details.

Step 3:

Verify with OTP: Submit the form and verify your identity using the OTP sent to your phone or email.

Step 4:

Check Your Score: View your credit score and download the report for reference.

#2. Pay Off Existing Debts and Bills on Time

Timely repayment of loans and credit card bills is one of the simplest yet most effective ways to build a strong credit score. Any delay or default can have a significant negative impact on your credit score.

Quick Action: Prioritize paying off high-interest debts first, and if possible, pay more than the minimum due each month. This reduces your outstanding balance and the interest you will have to pay.

3. Keep Your Credit Usage Low

Credit utilization means how much of your available credit you are using. Using too much of your credit limit—like more than 30%—shows that you depend a lot on credit, which can hurt your credit score.

Easy Fix: Use less than 30% of your credit limit. For example, if your credit card limit is ₹1,00,000, try to keep your spending below ₹30,000. If you often exceed this limit, consider asking your bank to increase your credit limit. This way, you’ll have more room to spend without crossing the 30% mark.

#4. Separate Your Personal and Business Finances

A common mistake among small business owners is mixing personal and business finances. This not only creates confusion but also affects your credit profile. Build a distinct business credit profile by keeping separate bank accounts, credit cards, and financial records.

Simple Start: Register your business, get a business PAN card, and open a business bank account. Ensure all business transactions flow through this account to build a separate credit history.

#5. Diversify Your Credit Types

Lenders prefer a mix of credit types, such as secured loans (like a car loan) and unsecured loans (like a credit card). This shows you can handle different types of credit responsibly.

Helpful Tip: If you only have credit cards, consider taking a small secured loan, like a gold loan or fixed-deposit loan. Paying it back on time can show lenders you can handle different types of credit and strengthen your credit profile.

#6. Avoid Applying for Multiple Loans at Once

Every time you apply for a loan, the lender performs a “hard inquiry” on your credit report, which can temporarily lower your credit score. Multiple applications within a short period can signal to lenders that you are desperate for credit.

Smart Move: Research loan options thoroughly and apply to one lender at a time. If rejected, find out why before applying again elsewhere.

#7. Maintain Up-to-Date Financial Records

For women entrepreneurs, especially those running MSMEs, having clean and organized financial records is crucial. Lenders will want to see your business’s financial health, including profit and loss statements, balance sheets, and cash flow statements.

Organize Better: Use simple accounting software or hire a part-time accountant to ensure all your financial statements are accurate and up-to-date. This builds lender confidence and speeds up the loan approval process.

8. Plan Your Loans Carefully

Applying for too many loans without planning can lead to trouble when it’s time to pay the EMIs. Also, be sure of the amount you want to borrow to avoid additional burdens on yourself. When applying for a business loan on the Mahila Money app, you can find your right capital match with our custom three business loan categories. You can even select the tenure based on your EMI calculation and see how much you must pay each month.

Smart Tip: Planning your loans helps you manage your finances better, make timely payments, and keep your credit score strong.

#9. Leverage Government Schemes and Alternative Lenders

Apart from traditional banks, look into government schemes and alternative lenders like NBFCs and fintech companies that provide loans specifically for women entrepreneurs. Many of these programs offer more flexible terms and lower interest rates.

Explore Options: Consider applying for a business loan from Mahila Money. We offer loans starting from Rs. 50,000 to 25 lacs, and they are collateral-free and paperless, without the need for a male guarantor.

Apply For a Business Loan.

Common FAQ’s Related To How To Build A Strong Credit Score

- What is considered a good credit score for a business loan?

A credit score above 750 is considered good for securing a business loan. A higher score increases your chances of getting approved with better terms, like lower interest rates.

2. How long does it take to improve a credit score?

Improving a credit score is a gradual process. Depending on your current score and how consistently you follow good credit practices, like timely payments and low credit usage, it can take anywhere from 3 to 6 months to see noticeable changes.

3. Will checking my credit score frequently hurt my score?

No, checking your credit score is considered a “soft inquiry” and does not affect it. However, checking your score regularly to track progress and spot errors is good practice.

4. How can I build a credit history if I have never taken a loan or credit card before?

If you’re new to credit, you can start by taking a small secured loan or applying for a credit card with a low limit. Use it responsibly by making timely payments, which will help build your credit history.

Take Charge of Your Credit Today!

To build a strong credit score isn’t a one-time task; it’s a continuous process that requires discipline and attention to detail. By following these steps, women entrepreneurs can significantly improve their chances of securing a business loan, closing the credit gap, and taking their businesses to new heights.

Check your credit score, review your financial habits, and set a plan to build a credit profile that makes lenders say “Approved”!

If you are a woman entrepreneur who wants to take your business to new heights and is in need of working capital and entrepreneurship resources, come speak to us on Mahila Money. For more such #JiyoApneDumPe live conversations, download the Mahila Money App on Play Store or visit us on www.mahila.money